Key Takeaways

- The S&P 500 gained 0.6% on Friday, Feb. 9, 2024, closing above the 5,000-point milestone for the primary time within the historical past of the index.

- Shares of semiconductor gear corporations pushed larger amid AI-driven enthusiasm and following dividend bulletins from a pair of trade gamers.

- Expedia Group shares plunged after the net journey firm reported weaker-than-expected bookings and introduced the departure of its CEO.

Main U.S. equities indexes had been blended on the ultimate buying and selling day of per week marked by earnings experiences from a wide range of main corporations.

The S&P 500 added 0.6%, reaching and shutting above 5,000 for the primary time within the index's historical past. The Nasdaq gained 1.3% on Friday, whereas the Dow recorded a slight decline of 0.1%. All three indexes had been in optimistic territory for the total week.

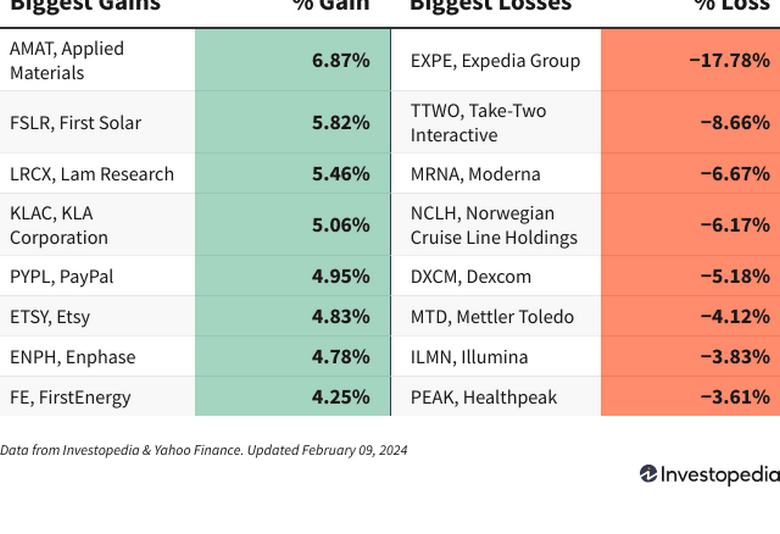

Semiconductor gear corporations have garnered consideration from traders for his or her potential to learn from a increase in synthetic intelligence (AI) expertise. Shares of Utilized Supplies (AMAT) led the way in which for the S&P 500 on Friday, gaining 6.9% because the agency prepares to launch its quarterly monetary outcomes on Thursday, Feb. 15.

Shares of two different gamers within the chip fabrication trade—Lam Analysis (LRCX) and KLA Corp. (KLAC)—superior 5.5% and 5.1% respectively after each corporations declared quarterly dividends.

It was additionally a robust finish to the week for photo voltaic vitality corporations after Enphase Power (ENPH) expressed optimism a couple of restoration in demand. Enphase shares added 4.8%.

The day’s weakest efficiency on the S&P 500 belonged to Expedia Group (EXPE). Shares plunged 17.8% after the net journey platform reported lower-than-expected gross bookings for the fourth quarter and introduced the resignation of its chief government officer (CEO).

Shares of Take-Two Interactive (TTWO) sank 8.7% after the online game maker reported lower-than-expected income for its not too long ago accomplished quarter and guided earnings for this quarter effectively beneath expectations. The corporate cited underperformance from its “NBA 2K24” recreation and weak point in cell promoting as elements affecting its outcomes.

Moderna (MRNA) shares slipped 6.7% amid issues in regards to the efficacy of the corporate’s vaccine towards respiratory syncytial virus (RSV). Knowledge instructed that the safety supplied by Moderna’s vaccine might decline shortly compared with competing merchandise.

Do you’ve gotten a information tip for Investopedia reporters? Please electronic mail us at

[email protected]