Key Takeaways

- The S&P 500 gained 0.8% on Wednesday, Feb. 7, 2024, as robust earnings experiences from tech and client discretionary corporations helped shares push increased.

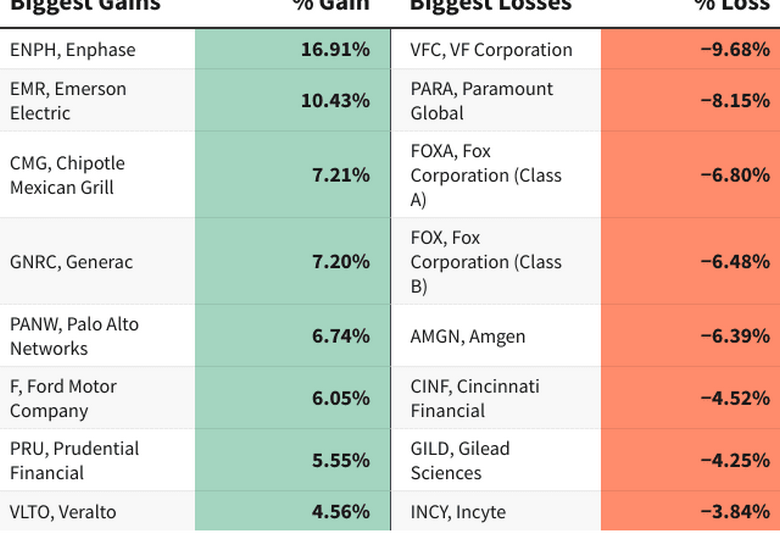

- Photo voltaic firm Enphase Power and electrical tools supplier Emerson Electrical issued optimistic 2024 forecasts, and their shares soared.

- Shares of VF Corp. dropped after the attire and footwear firm reported income declines throughout its core manufacturers.

Main U.S. equities indexes moved increased on Wednesday because the markets took within the newest sequence of quarterly monetary outcomes. Sturdy earnings experiences from know-how and client discretionary firms helped these sectors outperform.

The S&P 500 closed the hump day session 0.8% increased, whereas the Nasdaq and the Dow added 1.0% and 0.4%, respectively.

Shares of Enphase Power (ENPH) led the S&P 500 increased, skyrocketing 16.9%. The corporate missed top- and bottom-line estimates for the fourth quarter and offered steering under expectations for the present quarter. Regardless of that, the photo voltaic firm anticipates a restoration in demand and an enchancment in margins within the second half of 2024. Analysts at Oppenheimer agreed with Enphase’s upbeat stock and demand outlook, upgrading the inventory to Outperform on Wednesday morning.

A optimistic ahead outlook additionally helped increase shares of Emerson Electrical (EMR), which supplies electrical tools and engineering companies to numerous industries. Shares jumped 10.4% after Emerson boosted its second-quarter and full-year gross sales steering for fiscal 2024. Each of the corporate’s segments—Clever Gadgets in addition to Software program Management and Automation—reported income development within the not too long ago reported quarter.

Chipotle Mexican Grill (CMG) shares added 7.2% after the restaurant chain reported better-than-expected outcomes for the fourth quarter. The burrito maker reported 8.4% same-store gross sales development on elevated foot visitors through the quarter, at the same time as visits to different big-name meals chains declined over the ultimate months of 2023. The return of Chipotle’s carne asada and strikes to enhance retailer productiveness could have contributed to the robust outcomes.

Shares of VF Corp. (VFC) posted the steepest drop amongst S&P 500 shares, plunging 9.7% on Wednesday after the attire and footwear firm’s fiscal first-quarter income and gross sales fell shy of forecasts. Revenues declined throughout VF’s 4 core manufacturers—Vans, The North Face, Timberland, and Dickies—and the corporate introduced that its chief monetary officer (CFO) could be stepping down later this 12 months.

Paramount International (PARA) shares fell 8.2%, reversing the good points posted final week amid experiences that media mogul Byron Allen had prolonged a proposal to purchase the leisure firm. Whereas the thrill a few potential buyout stays lively, the corporate faces uncertainties associated to its enterprise technique and its Paramount+ streaming service.

It was additionally a down day for fellow media big Fox Corp. (FOXA). Shares tumbled 6.8% after Fox reported a year-over-year decline in income, reflecting the affect of decrease promoting gross sales. The corporate not too long ago made headlines for its plan to launch a joint sports activities streaming service with Walt Disney’s (DIS) ESPN and Warner Bros. Discovery (WBD).

Do you will have a information tip for Investopedia reporters? Please e-mail us at

[email protected]