A price-to-earnings ratio, or P/E ratio, is the measure of an organization’s inventory worth in relation to its earnings. When making an attempt to resolve whether or not to spend money on a sure inventory, utilizing the P/E might help you discover the inventory’s future course.

The P/E ratio may also assist inform you whether or not the worth is excessive or low, in comparison with different corporations in the identical sector.

In regards to the P/E Ratio

The P/E ratio was utilized by the late Benjamin Graham. Not solely was he Warren Buffett’s mentor, however he’s additionally credited with developing with “worth investing.”

Graham preached the virtues of this ratio as the most effective methods to know whether or not a inventory is buying and selling on an funding foundation or speculative foundation.

Notice

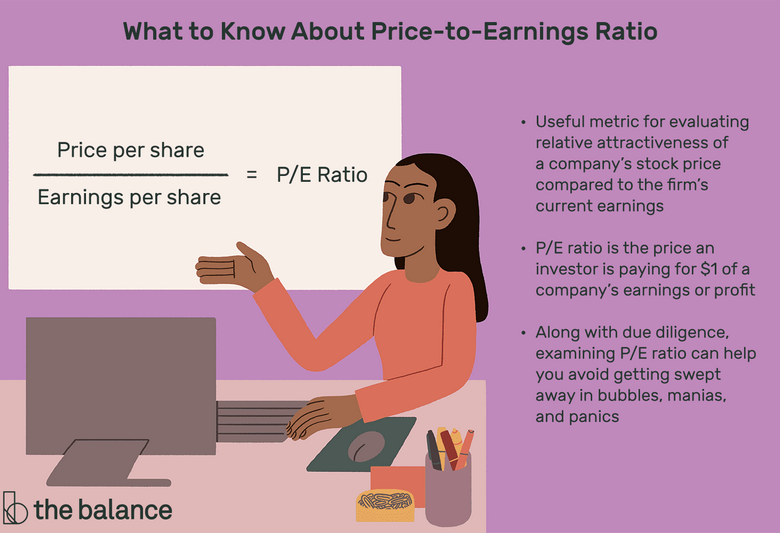

An earnings report tells you ways an organization is performing. The P/E ratio tells you ways buyers suppose the corporate is performing. In different phrases, it exhibits how a lot they’re keen to pay for $1 price of earnings.

How Does the P/E Ratio Work?

Earlier than you should utilize it, you must study what the P/E ratio is. It is easy to calculate so long as a given firm’s inventory worth and earnings per share (EPS). The equation appears like this:

- P/E ratio = worth per share ÷ earnings per share

As an instance an organization is reporting primary or diluted earnings per share of $2, and the inventory is promoting for $20 per share. In that case, the P/E ratio is 10 ($20 per share ÷ $2 earnings per share = 10 P/E).

This data is beneficial as a result of, for those who invert the P/E ratio, yow will discover out a inventory’s earnings yield. To seek out the yield, the equation appears like this:

- Earnings yield = earnings per share ÷ worth per share

This data can can help you examine the return you’re truly incomes from the underlying firm’s enterprise to different investments. These could embody Treasury payments, bonds, and notes, certificates of deposit and cash markets, actual property, and extra.

Make sure you do your analysis and look out for issues resembling worth traps. However taking a look at your portfolio by way of the P/E lens might help you keep away from getting swept away in bubbles or panics. It will probably additionally assist whether or not a inventory is getting overvalued and now not incomes sufficient to warrant its worth.

Warning

It’s best to by no means depend on P/E ratios alone if you select investments. P/E ratios might help information you however solely together with different analysis.

P/E Ratios by Sector

Every {industry} has a definite P/E vary that’s regular for that group. For example, Constancy analysis in early 2021 pegged the common well being care firm’s P/E ratio at practically 70. However, within the banking sector, corporations tended to have a P/E ratio of just below 11.5.

There’ll all the time be exceptions, nevertheless it’s regular for there to be these sorts of contrasts between sectors. That is partly as a result of totally different companies have totally different expectations. Within the software program sector, for instance, corporations typically have larger development charges and better returns on fairness. Which means they’ll promote at bigger P/E ratios.

Within the aftermath of the Nice Recession of 2008-2009, know-how shares traded at low P/E ratios, as a result of buyers have been scared. Because the economic system improved, buyers started returning. By 2021, Constancy estimated the industry-wide P/E common to be about 42.

How To Evaluate Firms With P/E Ratios

Not solely can you utilize the P/E ratio that will help you know which sectors are overpriced or underpriced, you can even examine the costs of corporations in the identical sectors. For example, if two corporations, ABC and XYZ, are each promoting for $50 per share, one is perhaps far costlier than the opposite. This will depend on the earnings and development charges of every inventory.

Suppose ABC reported earnings of $10 per share, and XYZ reported earnings of $20 per share. ABC has a P/E ratio of 5, whereas XYZ has a P/E ratio of two.5.

XYZ is a greater buy at the moment, due to the decrease share worth together with comparable earnings. For every share bought, you are getting $20 of earnings from XYZ moderately than $10 in earnings from ABC.

Limitations of the P/E Ratio

Understand that there’s not one single ratio or set rule you may apply for investing success. It’s essential to consider what’s going on on the earth, the markets, and the economic system. For example, if the economic system is in hassle, or there’s a international well being disaster, company earnings may be worse than anticipated, and inventory costs can change typically. An funding could begin to decline and appear pretty valued at a P/E ratio of 14. However then, for those who bounce into the place too quickly with out wanting on the total market, the P/E may decline additional.

However, throughout booming economies, company earnings can proceed to rise, and the P/E ratio can hold growing for a few years in a row.

A low inventory worth does not all the time imply you can purchase it, and nor does a low P/E ratio. With out broader context, you may’t ensure that a low P/E actually alerts an excellent funding.

Some buyers could favor the price-to-earnings development (PEG) ratio as a substitute, as a result of it components within the earnings development fee. Different buyers could favor the dividend-adjusted PEG ratio as a result of it makes use of the fundamental P/E ratio. It additionally adjusts for each the expansion fee and the dividend yield of the inventory.

The Backside Line

In case you are tempted to purchase a inventory as a result of it has an excellent P/E ratio, you should definitely do your analysis and work out whether or not it is actually nearly as good because it appears.

Ask your self these questions: Is administration sincere? Is the enterprise shedding key purchasers? Is the inventory worth or efficiency a results of forces throughout the complete sector, {industry}, or economic system? Or is it brought on by firm-specific unhealthy information? Is the corporate going right into a state of decline?

The essential P/E ratio is an indicator that is nice when utilized in context, nevertheless it’s not all that helpful by itself—no less than not till you grow to be very accustomed to your investments and alternatives.

As you study extra in regards to the ratios, together with the sectors you need to spend money on, you’ll view an organization’s P/E from a sure time. Then, you may resolve whether or not it’s a good indicator or not.

Often Requested Questions (FAQs)

What does a damaging P/E ratio imply?

A damaging P/E implies that an organization just isn’t worthwhile. In these instances, the P/E ratio tells you ways a lot cash the corporate misplaced with each greenback you invested.

Which kinds of corporations are inclined to have a low P/E ratio?

In line with Constancy analysis, corporations within the monetary sector have the bottom P/E ratio on common.

What’s the P/E ratio of the S&P 500?

The S&P 500 index’s P/E ratio is about 31. That locations it under the Nasdaq, which has a P/E ratio of about 36, however above the Dow Jones Industrial Common, which has a P/E ratio of about 24.