Key Takeaways

- The S&P 500 gained 1.1% on Friday, Feb. 2, 2024, following a surprisingly robust jobs report and spectacular earnings outcomes from Meta and Amazon.

- Shares of Meta skyrocketed after the Fb dad or mum reported better-than-expected earnings and declared its first-ever dividend.

- Constitution Communications shares plunged after the cable firm disclosed a decline in broadband web subscribers.

U.S. equities indexes climbed greater on Friday because the Bureau of Labor Statistics (BLS) confirmed the labor market added 353,000 jobs in January, practically doubling economists’ forecasts. A number of tech giants additionally exceeded expectations with earnings outcomes launched Thursday afternoon, bolstering the markets and underpinning outperformance by the communication companies sector.

The S&P 500 superior 1.1% to a different document closing excessive, whereas the Dow recovered from a gradual begin to the buying and selling day to finish Friday's session 0.4% greater. Receiving a lift from stable tech earnings, the Nasdaq gained 1.7%. All three indexes had been in optimistic territory for the week.

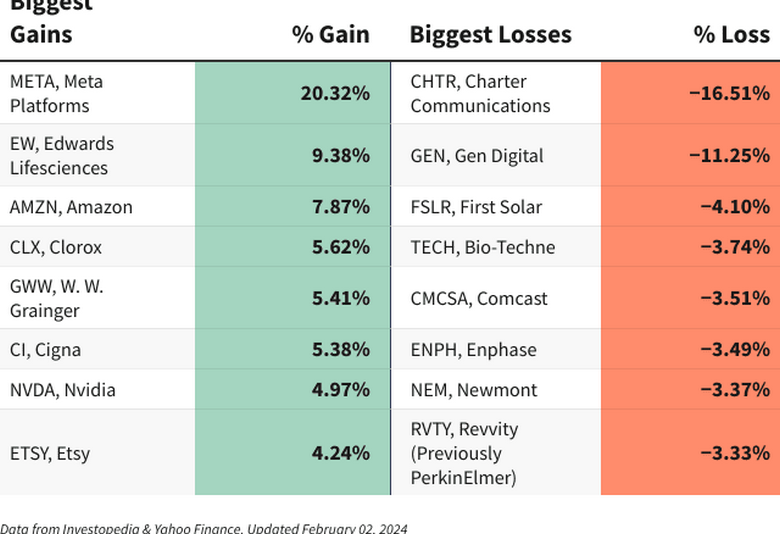

Shares of Fb dad or mum Meta Platforms (META) topped the S&P 500, skyrocketing 20.3% after the social media big exceeded fourth-quarter earnings estimates. The corporate additionally declared a dividend for the primary time in its historical past and approved an extra $50 billion price of share repurchases.

Edwards Lifesciences (EW) shares jumped 9.4% after the medical system maker acquired approval from the Meals and Drug Administration (FDA) for its Evoque valve alternative system. Edwards’ product is the primary transcatheter remedy to be cleared by the FDA for the remedy of tricuspid regurgitation (TR), a sort of coronary heart illness.

Amazon (AMZN) shares popped 7.9% greater after the corporate reported robust earnings outcomes for the fourth quarter. The e-commerce juggernaut highlighted that it topped its document for objects bought through the vacation season in 2023 as clients took benefit of low costs and fast supply instances. The corporate additionally posted greater income from promoting and its AWS cloud division.

Constitution Communications (CHTR) didn’t fare as effectively with its quarterly outcomes. Shares of the cable firm plunged 16.5%, making it the weakest inventory on the S&P 500, after fourth-quarter earnings fell shy of expectations. Constitution additionally reported an surprising decline in broadband web subscribers, with many of the losses coming from residential clients.

Gen Digital (GEN), proprietor of cybersecurity and identification safety merchandise Norton and LifeLock, additionally reported weaker-than-expected quarterly income and revenues whereas forecasting below-consensus outcomes for the present quarter. Its shares tumbled 11.3%

First Photo voltaic (FSLR) shares slipped 4.1% after analysts at BMO lowered their worth goal on the inventory. Together with Friday’s losses, shares of the photo voltaic firm are down greater than 15% over the previous 12 months.

Do you’ve gotten a information tip for Investopedia reporters? Please e-mail us at

[email protected]