January retail gross sales, due out this morning, are anticipated to indicate a slight decline from the earlier month however continued power as customers drive U.S. financial progress. Cisco Programs (CSCO) shares have been down after the pc {hardware} firm late Wednesday introduced weak steerage and job cuts, whereas chip tools maker Utilized Supplies Inc. (AMAT) and crypto alternate platform Coinbase (COIN) are attributable to report after the closing bell. Right here’s what traders must know right this moment.

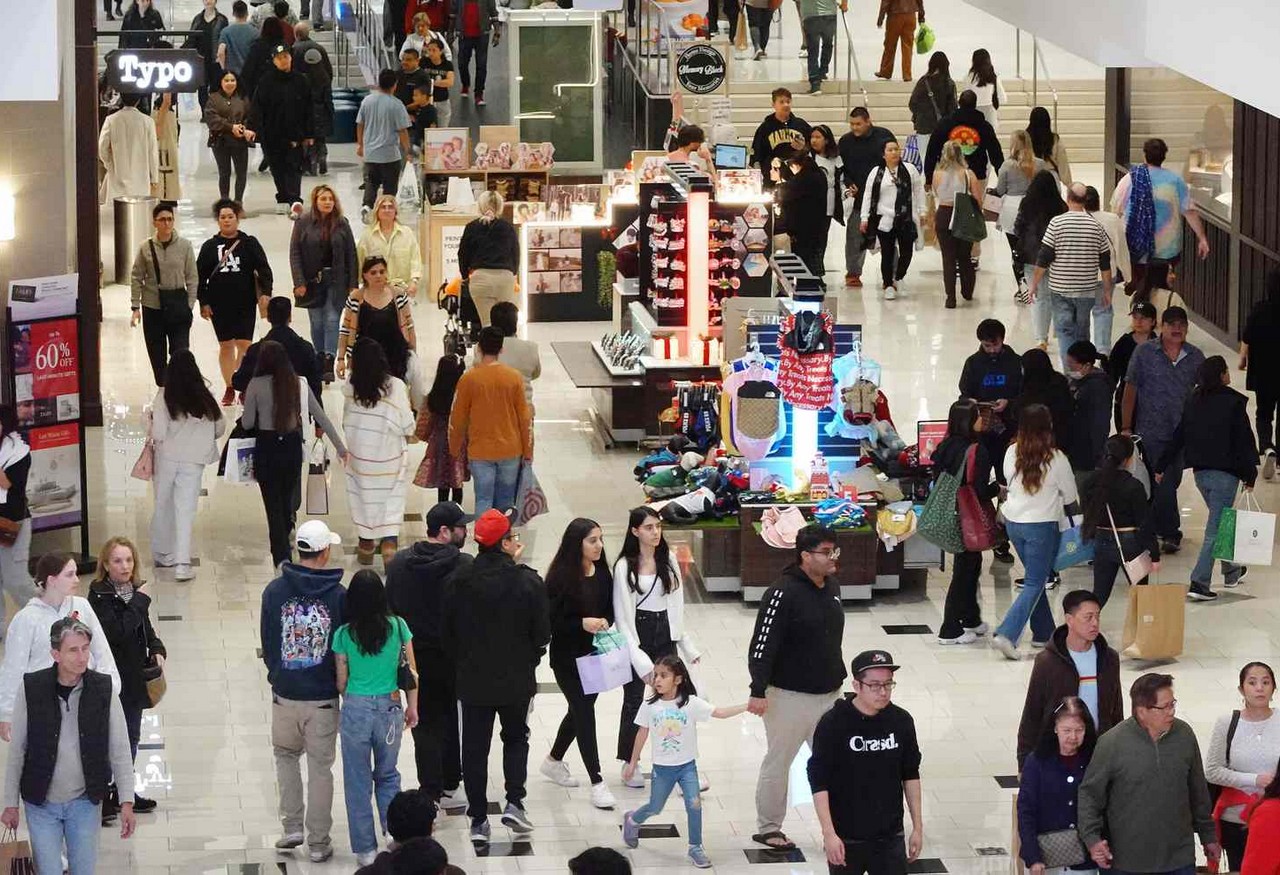

1. Retail Gross sales Anticipated to Present Continued Power

January’s U.S. retail gross sales knowledge from the Census Bureau are anticipated to indicate a 0.1% decline by from the prior month, following December’s 0.6% achieve. Nonetheless, early figures present that spending stays buoyant and a key financial driver, even when final month’s winter chilly weighed on mall-shopping and better rates of interest dampened car-buying. In accordance with a CNBC/Nationwide Retail Basis report launched Monday, core retail gross sales, which excludes risky vehicle, gasoline and restaurant gross sales, have been 3.2% increased than the year-ago in January, beating December’s 2.4% yearly surge. Different indicators due right this moment that may give indicators of the well being of the U.S. economic system are weekly jobless claims and the homebuilder confidence index.

2. Cisco Falls on Cautious Steerage, Job Cuts

Cisco Programs (CSCO) shares have been down greater than 4% in pre-market buying and selling after the computer-networking big late Wednesday issued softer-than-expected present quarter steerage and stated it plans to chop 5% of its international workforce, or round 4,250 positions. Cisco CEO Chuck Robbins stated slowing company spending and an unsure broader economic system had prompted the cautious method to the corporate’s outlook. Cisco’s job cuts are the newest in a string of tech layoffs this month alone, with Snap (SNAP), DocuSign (DOCU) and Maplebear Inc. (CART) among the many others decreasing headcount.

3. Buffett’s Berkshire Hathaway Trims Apple Stake

Warren Buffett’s Berkshire Hathaway Inc. (BRK.A, BRK.B) reportedly bought about 1% of its Apple (AAPL) shares within the remaining three months of 2023, leaving it with a 5.9% stake within the iPhone maker. Apple’s share worth good points have lagged its tech friends, who’ve surged on the again of the investor frenzy for synthetic intelligence shares, with the corporate additionally coping with challenges like a China gross sales stoop and regulatory give attention to its App retailer insurance policies. Apple shares have been down 0.7% in pre-market buying and selling.

4. Coinbase Shares Soar Forward of This fall Outcomes

Coinbase World (COIN) shares have been almost 7% increased forward of reporting fourth-quarter earnings after the market shut. The outcomes are anticipated to indicate a bounce in income and bullish steerage amid good points in bitcoin (BTCUSD), which has surged above $52,000 this week. The most important cryptocurrency alternate within the U.S. is predicted to indicate a income of $811.3 million, a 29% improve over the year-ago interval, in accordance with knowledge from Seen Alpha. Analysts additionally count on that Coinbase swung to a revenue of 89 cents per share within the fourth quarter, in contrast with a lack of 83 cents a 12 months earlier.

5. Utilized Supplies More likely to Present Earnings Decline

Utilized Supplies Inc. (AMAT), which additionally experiences after the closing bell, is predicted to indicate declines for its prime and backside traces. The maker of semiconductor-manufacturing tools is ready to report earnings per share of $1.92 per share for its fiscal first quarter 2024, down from $2.03 in accordance with estimates from Seen Alpha. Income is ready to fall to $6.50 from $6.74 billion. The corporate’s {hardware} is utilized in chips made by Intel (INTC) and Taiwan Semiconductor Manufacturing Firm (TSM).

Do you may have a information tip for Investopedia reporters? Please e-mail us at

ideas@investopedia.com