Key Takeaways

- The S&P 500 gained 1.0% on Wednesday, Feb. 14, 2024, recovering among the floor it misplaced within the prior session after hotter-than-expected inflation information.

- Shares of Uber soared after the ride-hailing firm introduced its first-ever inventory buyback program.

- Regardless of posting robust general monetary outcomes, MGM Resorts reported weak point in its regional operations, and its shares dropped.

Main U.S. equities indexes rebounded on Wednesday, recovering among the floor they misplaced within the earlier session. The S&P 500 superior 1.0%, whereas the Nasdaq and the Dow have been up 1.3% and 0.4%, respectively.

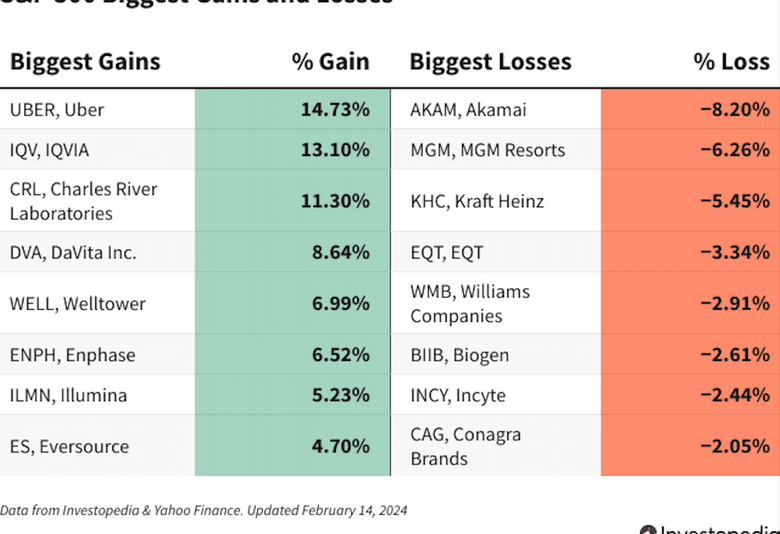

Shares of Uber Applied sciences (UBER) led the S&P 500 increased, hovering 14.7% after the ride-hailing and food-delivery firm introduced its first-ever share repurchase program. Uber disclosed the plan to purchase again as much as $7 billion in shares after posting its first annual web revenue as a public firm when it reported earnings final week.

IQVIA Holdings (IQV), a life sciences firm serving the well being info expertise and scientific analysis industries, reported fourth-quarter gross sales and income that exceeded consensus estimates. The corporate achieved robust progress and an elevated backlog in its analysis and growth (R&D) options section. IQVIA shares jumped 13.1% on Wednesday.

A powerful earnings report additionally helped elevate shares of Charles River Laboratories (CRL), which added 11.3% after the well being care diagnostics and analysis agency posted better-than-expected outcomes for the fourth quarter and launched upbeat 2024 steerage. The corporate anticipates its not too long ago accomplished acquisition of Noveprim, which offers non-human primates for drug analysis, will enhance its income this yr.

Shares of Akamai Applied sciences (AKAM) posted Wednesday’s steepest losses amongst S&P 500 shares, falling 8.2%. Though the cloud computing and cybersecurity software program agency beat fourth-quarter revenue estimates, its income for the interval and its steerage for the following quarter fell in need of expectations. Regardless of a robust efficiency in cloud and safety software program, softness in Akamai’s legacy content material supply community (CDN) enterprise negatively affected the outcomes and outlook.

Though on line casino and lodge operator MGM Resorts Worldwide (MGM) beat top- and bottom-line estimates for the fourth quarter, its shares slipped 6.3%. Regardless of the robust general outcomes, the corporate reported a income decline in its regional operations, reflecting the influence of a strike by staff at MGM Grand Detroit and decrease high-end gaming exercise at MGM Nationwide Harbor.

Shares of Kraft Heinz (KHC) dropped 5.5% after the packaged meals big reported a decline in gross sales, which got here underneath stress from increased costs and decrease demand. The maker of macaroni and cheese, ketchup, and different meals merchandise famous that it faces headwinds associated to shopper stress, though it expects the state of affairs to enhance.

Do you may have a information tip for Investopedia reporters? Please electronic mail us at

[email protected]