Key Takeaways

- The rise of the elite tech shares has left the S&P 500 at its most concentrated in a minimum of the final 100 years, in response to Deustche Financial institution analysts, posing dangers and spillovers for different belongings.

- Amongst fund managers surveyed by Financial institution of America, 61% stated that "Lengthy Magnificent Seven" is at present the most-crowded commerce.

- Lofty valuations may liken the present tech inventory euphoria to the Dotcom bubble of 1999-2000, however the state of affairs at present is vastly completely different.

Traders have been piling into the ‘Magnificent Seven’ shares—an elite group of among the largest know-how firms—driving shares to sky-high valuations, and main indexes to document highs, on expectations that synthetic intelligence (AI)-related enterprise progress will assist continued features.

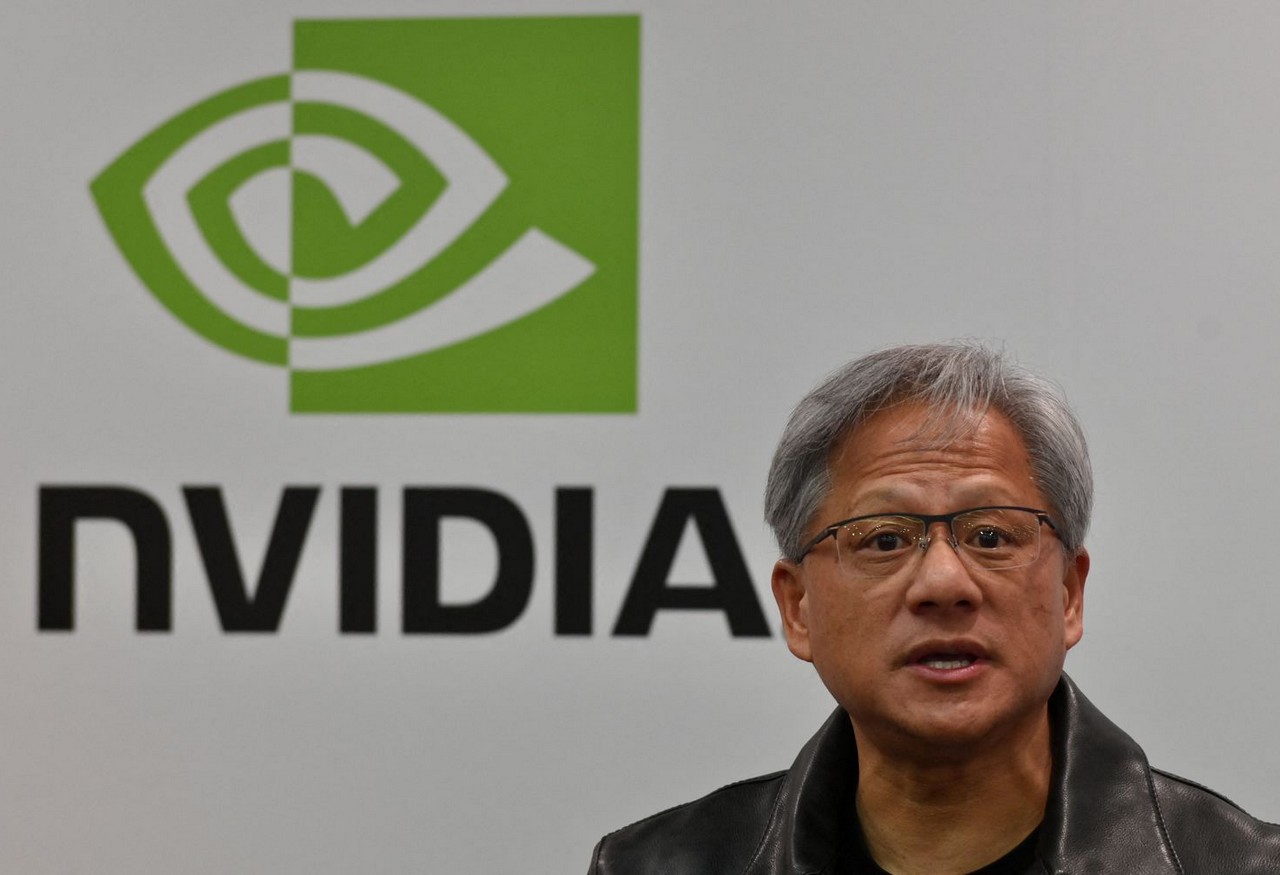

Nonetheless, the surge in investor curiosity in ‘Magazine 7’ members Alphabet (GOOGL; GOOG), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) will not be with out danger.

"The Magazine 7’s rise has left the S&P 500 at round its most concentrated in a minimum of the final 100 years. Maybe not because the bubble of 1929 have so few shares had such excessive weightings to the general market" Deutsche Financial institution analysts led by Jim Reid wrote in a analysis word Tuesday. "In flip, their future efficiency will seemingly affect nearly all of world belongings to some, or to a fantastic, diploma going ahead."

Deustche Financial institution

Priced for Perfection?

Whereas the AI growth, community results and U.S. authorities incentives may propel the Magnificent Seven shares additional, analysts at Deutsche Financial institution cited heightened regulatory and public scrutiny of huge tech firms and AI basically, in addition to geopolitical elements, as potential headwinds.

"As well as, no-one fairly is aware of how AI will pan out and who will win," Deutsche Financial institution stated within the report. "Tech adjustments quickly over time. Present excessive valuations assume Magazine 7 will all the time win."

For now, that appears to be the prevailing knowledge. In line with Financial institution of America’s newest International Fund Supervisor Survey, additionally launched Tuesday, 61% of fund managers consider that “Lengthy Magnificent Seven” is at present the most-crowded commerce, with “Brief China equities” coming in subsequent at 25%. The survey confirmed that allocation to tech shares is at its highest degree since August 2020.

Not like the Dotcom Bubble

Lofty valuations may liken the present tech inventory euphoria to the Dotcom bubble of 1999-2000, in response to the Man Institute, however the state of affairs at present is vastly completely different.

"The market will not be rewarding simply any unproven enterprise fashions prefer it did through the tech bubble, this rally is pushed by confirmed enterprise fashions producing billions of extra free money circulation {dollars}," the institute wrote in a word Tuesday. "With substantial capital expenditure and an acceleration in Synthetic Intelligence (AI) algorithms, there may be sufficient momentum suggesting a sturdy basis for present and (presumably even future) valuations to drive actual financial progress."

Shares of all the Magnificent Seven members fell on Tuesday, in keeping with a broader market decline prompted by knowledge exhibiting that U.S. inflation in January hadn’t moderated as a lot as economists anticipated, which quelled optimism that the Federal Reserve may begin reducing rates of interest quickly.

Nonetheless, shares of every of the group's members, except Tesla (down 12%), have posted important features over the previous 12 months. Nvidia shares have risen essentially the most, tripling over the previous 12 months by means of Tuesday's shut, whereas Meta has risen 156%. Shares of Amazon are up almost 70%, whereas Alphabet and Microsoft have every gained about 50%, and Apple is up about 20%.

Do you might have a information tip for Investopedia reporters? Please electronic mail us at

[email protected]