The nation’s youngest owners have been outpaced by their mother and father and grandparents final yr, however the a lot sought-after buying demographic is doing higher than its elders in some methods, Redfin discovered.

Simply 26.3% of Gen Zers, or these born between 1997 to 2012, owned a house final yr, the digital brokerage reported Wednesday. That price ticked up by 0.1% yearly, a progress lagging behind millennials, of which 54.8% owned a house final yr, and Gen Xers, of which 72% owned a house.

Like all potential consumers, 19-to-26 yr olds final yr encountered steep unaffordability, though mortgage charges pale to shut the yr after nearly approaching 8%.

Gen Zers are nonetheless outpacing their mother and father and grandparents in a single respect, nonetheless: 27.8% of 24-year-old Gen Zers personal a house, in comparison with 24.5% of Millennials once they have been that age, and 23.5% of Gen Xers on the similar degree of maturity. The brokerage cited historic U.S. Census Bureau homeownership information as the idea for its findings.

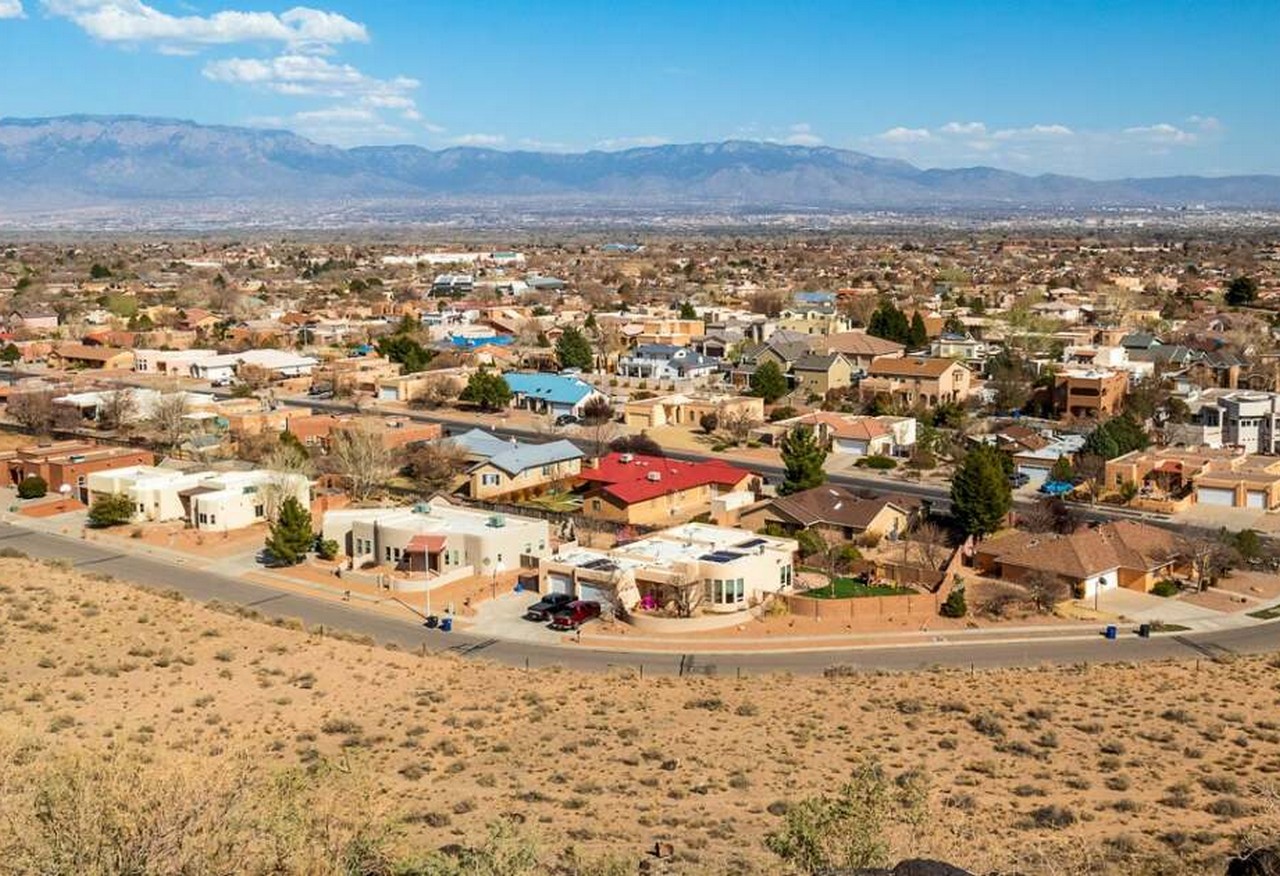

Younger consumers are emboldened by distant work alternatives which permit them to select affordability over costly city markets, Redfin Chief Economist Daryl Fairweather stated within the report.

“The latest decline in rents means Gen Zers can put more cash towards saving for a down fee,” she added.

Many Gen Z owners seemingly bought in the course of the ultra-low price period of 2020 and 2021, the brokerage’s economists steered. Their advantageous window compares favorably to Millennials, who of their early 20s lived by the Nice Recession, and Gen Xers who confronted mortgage charges round 11% in 1989, when the oldest of that group have been 24 years previous.

Gen Zers put a heavy emphasis on shopping for a house however are extra involved with erasing debt, resembling scholar loans, within the close to time period, in response to a FinLocker survey final yr. Whereas mortgage lenders are looking for to courtroom younger homebuyers with enticing advertising and marketing, Gen Z themselves are looking for to spice up their earnings by way of strategies resembling “home hacking“, or incomes rental earnings.