Key Takeaways

- The S&P 500 slid lower than 0.1% on Monday, Feb. 12, 2024, remaining comparatively flat forward of Tuesday's Client Value Index (CPI) report.

- Shares of Motorola Options dropped after the communications gear agency issued a lower-than-expected 2024 revenue forecast.

- VF Corp. shares skyrocketed following studies that the household that based the clothes conglomerate would assist initiatives by activist investor Engaged Capital.

Main U.S. equities indexes had been blended to open the buying and selling week, with Tuesday’s launch of Client Value Index (CPI) information and extra company earnings studies on the horizon.

The S&P 500 fell 0.1%, failing to construct on Friday's record-setting shut however remaining above the historic 5,000 degree. With a acquire of 0.3%, the Dow did handle to attain a brand new all-time excessive. In the meantime, the Nasdaq closed the session 0.3% decrease.

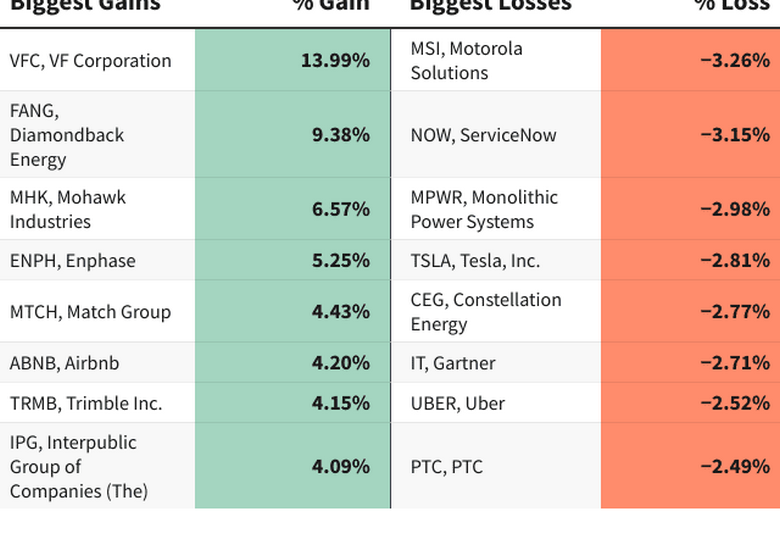

Shares of Motorola Options (MSI) slid 3.3%, marking Monday’s weakest efficiency on the S&P 500. Regardless of final week’s earnings report displaying stronger-than-expected gross sales and earnings for the fourth quarter, the telecommunications gear supplier’s adjusted revenue steerage for 2024 got here in under expectations.

After opening the day larger, shares of enterprise cloud computing agency ServiceNow (NOW) closed the session with a lack of 3.2%. Though the inventory has gained greater than 14% to date in 2024 amid enthusiasm about ServiceNow’s potential to assist corporations automate their operations and enhance gross sales, current studies have proven firm insiders unloading shares.

Monolithic Energy Programs (MPWR) shares fell 3.0%, reversing among the large beneficial properties posted late final week after the supplier of energy administration gadgets reported robust quarterly outcomes and issued an upbeat 2024 forecast. Analysts instructed current advances within the share value could also be misaligned with the corporate’s income trajectory.

VF Corp. (VFC) topped S&P 500 shares following studies that activist investor Engaged Capital had secured assist from the clothes agency’s founding household to implement adjustments. Shares of the corporate, which owns Vans, The North Face, and different attire manufacturers, skyrocketed 14.0%.

Shares of Diamondback Power (FANG) jumped 9.4% after the oil and gasoline firm introduced plans for a merger with Endeavor Power Sources in a deal value $26 billion. The newest in a string of exercise within the vitality sector, the deal would increase the corporate’s place within the Permian Basin, the top-producing oilfield within the U.S.

Mohawk Industries (MHK) shares added 6.6% after the flooring producer’s full-year earnings per share (EPS) for 2023 exceeded expectations, benefitting from decrease enter prices and measures to enhance productiveness. Analysts at Deutsche Financial institution upgraded Mohawk inventory to Purchase and lifted their value goal to $152, citing the potential for enhanced effectivity to drive extra revenue development.

Do you might have a information tip for Investopedia reporters? Please e mail us at

[email protected]