Key Takeaways

- The S&P 500 fell 1.4% on Tuesday, Feb. 13, 2024, after the newest Client Value Index (CPI) knowledge confirmed inflation cooled lower than anticipated in January.

- Shares of Moody's tumbled after the credit standing agency reported weaker-than-expected quarterly outcomes and named a brand new CFO.

- Ecolab shares soared because the supplier of hygiene options topped estimates, with a lift from new prospects and better costs.

U.S. equities posted steep losses after the newest knowledge from the Bureau of Labor Statistics (BLS) revealed that client costs rose greater than anticipated in January. The Federal Reserve is on the lookout for indicators of a sustained cooldown in inflation earlier than it reduces rates of interest, and after in the present day’s Client Value Index (CPI) report, the probability of a fee minimize in Might dwindled.

The S&P 500 dropped 1.4% following the hotter-than-expected inflation print. The Dow additionally misplaced 1.4%, whereas the tech-heavy Nasdaq fell 1.8%.

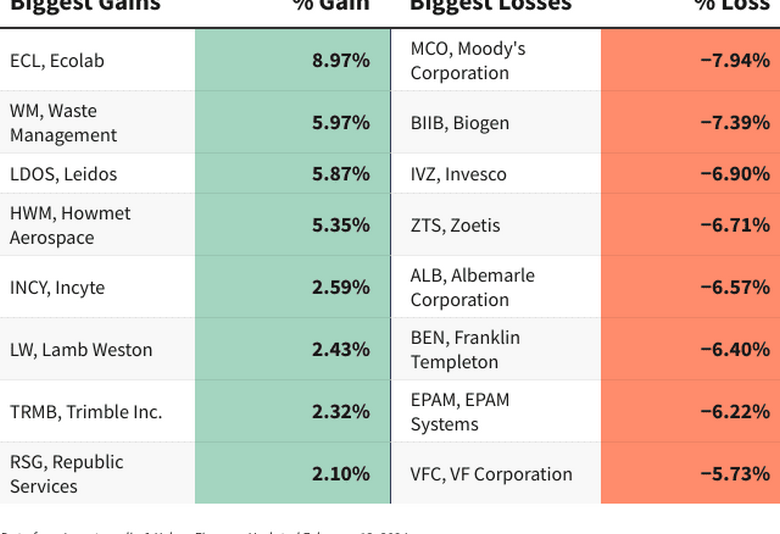

The weakest efficiency amongst S&P 500 shares on Tuesday got here from Moody’s Corp. (MCO). Shares tumbled 7.9% after the monetary analysis agency’s fourth-quarter gross sales and earnings fell shy of expectations. Softness on the credit score scores and evaluation unit contributed to the miss, and Moody’s introduced {that a} new chief monetary officer (CFO) will step into the position later this yr.

Biogen (BIIB) additionally reported quarterly income and earnings numbers that did not match analysts’ forecasts, and its shares fell 7.4%. The biotech agency discontinued growth and commercialization of Aduhelm, a controversial Alzheimer’s therapy, whereas gross sales of its a number of sclerosis medicines declined amid intensifying competitors.

Shares of Invesco (IVZ) dropped 6.9% after the funding supervisor reported a month-over-month decline in property beneath administration (AUM) for January. Regardless of its numerous product providing, Invesco faces macroeconomic and working headwinds that would have an effect on its gross sales within the close to time period.

In the meantime, Tuesday’s largest positive factors on the S&P 500 belonged to Ecolab (ECL), which offers water, hygiene, and an infection prevention options. The corporate reported sturdy outcomes for the fourth quarter, boosted by larger costs and buyer additions, notably in its institutional and specialty section. Its shares soared 9.0% following the earnings launch.

Shares of Waste Administration (WM) jumped 6.0% after the rubbish removing firm exceeded top- and bottom-line estimates with its quarterly outcomes. The agency is at present investing in its capability to generate vitality utilizing fuel harvested from landfills, which may enhance its future earnings.

A greater-than-expected earnings report additionally helped elevate shares of protection contractor Leidos (LDOS), which added 5.9% on Tuesday. Heightened geopolitical tensions may improve demand for the corporate’s merchandise, and analysts at Stifel boosted their worth goal on Leidos inventory.

Do you’ve a information tip for Investopedia reporters? Please e-mail us at

[email protected]