Key Takeaways

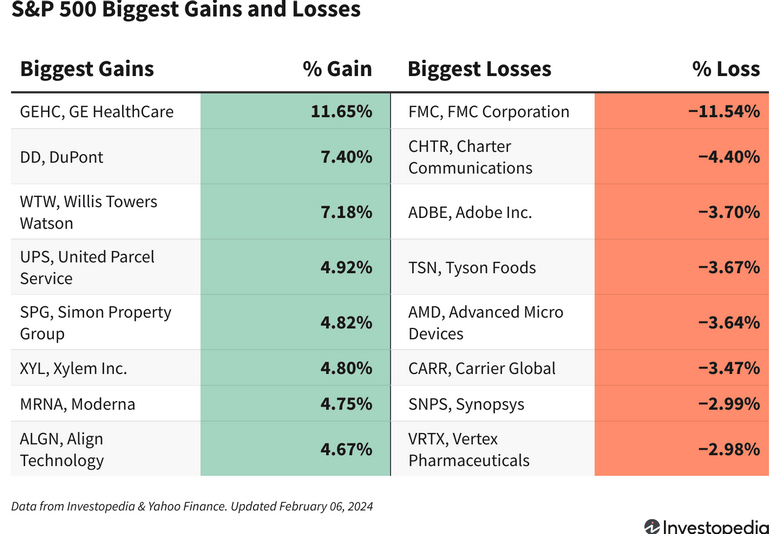

- The S&P 500 gained 0.2% on Tuesday, Feb. 6, 2024, as Federal Reserve officers struck a tone of cautious optimism and extra corporations launched quarterly outcomes.

- GE HealthCare shares soared as progress in imaging and affected person care options helped drive sturdy earnings.

- Shares of FMC Corp. tumbled after the agriculture agency offered lackluster steering, reflecting the influence of low gross sales quantity and destocking points.

Main U.S. inventory indexes posted reasonable positive aspects as extra corporations reported earnings outcomes. In the meantime, feedback from Federal Reserve officers highlighted the optimistic indications from current financial knowledge, even when policymakers are usually not able to declare victory of their mission to stamp out inflation.

The S&P 500 added 0.2% in Tuesday's session, and the Dow was up 0.4%. The Nasdaq eked out a acquire of lower than 0.1%.

GE HealthCare Applied sciences (GEHC), which accomplished its spinoff from Normal Electrical (GE) initially of 2023, was Tuesday’s high inventory on the S&P 500. Shares soared 11.7% after the supplier of medical gadgets and providers reported better-than-expected fourth-quarter gross sales and earnings. Income progress within the firm’s imaging and affected person care options segments helped drive the sturdy outcomes.

Strong quarterly outcomes additionally helped increase shares of DuPont de Nemours (DD), which jumped 7.4%. Along with beating Wall Avenue’s consensus revenue forecast for the fourth quarter, the specialty chemical substances agency boosted its quarterly dividend by 6% and declared a brand new $1 billion share repurchase program. The corporate anticipates a stabilization of demand in China in addition to in its semiconductor and electronics companies.

One other set of sturdy outcomes got here from insurer Willis Towers Watson (WTW), which exceeded bottom-line estimates on sturdy year-over-year income progress. Highlights included the danger and broking phase, which obtained a lift from new enterprise, higher consumer retention, and better charges. Shares of the agency gained 7.2% on Tuesday.

Shares of FMC Company (FMC) noticed the steepest losses amongst S&P 500 shares, plunging 11.5% after the agricultural sciences agency issued weaker-than-expected steering for the primary quarter. FMC reported a major gross sales drop in its Latin America enterprise within the fourth quarter, and it faces quite a few headwinds associated to destocking and low gross sales volumes.

Constitution Communications (CHTR) shares fell 4.4% after analysts at Wells Fargo and JPMorgan downgraded the inventory, citing considerations concerning the aggressive atmosphere and the cable firm’s progress trajectory. Tuesday’s downturn prolonged the steep losses posted on Friday after Constitution reported an sudden drop in broadband web subscribers.

Shares of Tyson Meals (TSN) slipped 3.7%. Though the inventory initially jumped increased on Monday after the meat producer reported better-than-expected quarterly earnings, the demand image stays unsure as customers navigate the high-price atmosphere, and Tyson’s beef enterprise faces pressures associated to low U.S. cattle provides.

Do you might have a information tip for Investopedia reporters? Please e-mail us at

[email protected]