Do CDs Pay Compound Curiosity?

Certificates of deposit (CDs) typically pay increased rates of interest than different sorts of financial savings accounts provided by banks and credit score unions. Most additionally pay compound curiosity—that’s, curiosity on the curiosity you have already earned. On this article, we’ll take a look at the distinction that compound curiosity

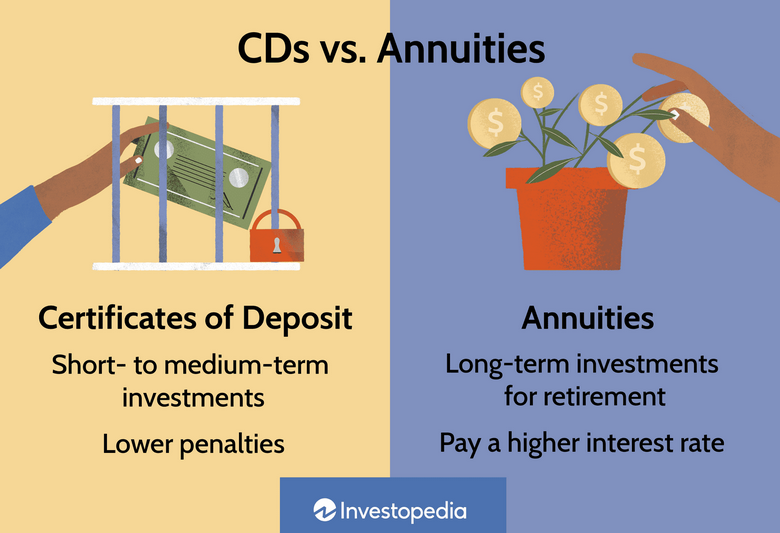

CDs vs. Annuities: What's the Distinction?

CDs vs. Annuities: An Overview Certificates of deposit (CDs) and annuities can each be good methods to avoid wasting for the longer term. Each kinds of funding supply a low-risk, low-return method of investing. Nonetheless, there are some vital variations between these monetary merchandise. Crucial is the size of time

CDs vs. Crypto: What's the Distinction?

CDs vs. Crypto: An Overview Within the hierarchy of funding devices concerning threat and return, conventional saving accounts have the bottom threat and reward. A small step up from a financial savings account is a certificates of deposit. That is an account you place your cash in at a financial

Greatest 4-Yr CD Charges for February 2024

Lafayette Federal Credit score Union – 4.73% APY Time period (months): 48 Minimal deposit: $500 Early withdrawal penalty: 16 months of curiosity Membership: Anybody can be part of Lafayette Federal with a $10 membership within the House Possession Monetary Literacy Council and $50 or extra held in a financial savings account. Credit score Human

Finest 3-Month CD Charges for February 2024

TotalDirectBank – 5.51% APY Time period (months): 3 Minimal deposit: $25,000 Early-withdrawal penalty: 1 month of curiosity About: TotalDirectBank is an online-only operation of Metropolis Nationwide Financial institution of Florida, established in Miami in 1946. Dow Credit score Union – 5.30% APY Time period (months): 3 Minimal deposit: $500 Early

Inherited CDs: How and When to Reinvest Your Funds

Certificates of deposit (CDs) are a low-risk approach to put some cash apart for the short- to medium-term future and earn a modest return within the meantime. This makes them appropriate and widespread for seniors who’ve further financial savings in retirement, and a standard a part of inheritance settlements. There

Can You Bypass Probate With CDs?

Certificates of deposit (CDs) usually kind a part of an inheritance. These are low-risk investments, out there by any financial institution, credit score union, or brokerage, that enable individuals to deposit some spare money for a brief time period in return for a modest return. They could become significantly priceless

Who Can Be a Switch on Demise (TOD) Beneficiary?

People can specify an individual as a switch on dying (TOD) beneficiary for retirement or different monetary accounts, resembling financial savings accounts. Beneficiaries obtain the property held within the accounts when the proprietor dies. Naming beneficiaries helps heirs keep away from the generally pricey technique of probate. A TOD beneficiary could

Can You Purchase a CD with International Foreign money in a International Nation?

Investing in certificates of deposit (CDs) in a rustic exterior the U.S. is unquestionably attainable. Nevertheless, it’s a lot riskier than placing your cash in a U.S.-based CD. Certificates of deposit (CDs), typically often known as time deposits exterior the U.S., are a low-risk method to retailer your financial savings

CDs vs. ETFs: What's the Distinction?

CDs vs. ETFs: An Overview Certificates of deposit (CDs) and exchange-traded funds (ETFs) are two standard funding choices. Each permit you to save a few of that additional money apart whereas promising you a modest return. They’re thought of to be low-risk funding automobiles, which suggests you received't be making