- A belief fund is a particular kind of authorized entity that holds property for the good thing about one other particular person, group, or group.

- There are three events concerned in a belief fund: the grantor, the trustee, and the beneficiary.

- A belief fund units guidelines for the way property may be handed on to beneficiaries.

- Belief funds may be revocable or irrevocable. Irrevocable trusts have extra advantages.

- Belief funds be sure that your loved ones abides by your needs and affords tax advantages.

Definition and Examples of Belief Funds

A belief fund is usually used as an property planning instrument. It is used to reduce taxes and keep away from probate, which is the authorized course of used to distribute the property of a deceased particular person.

Whereas there are a lot of particular forms of belief funds, they fall into two important classes:

- Revocable: Such a belief is often known as a “residing belief.” These trusts are versatile and may be dissolved. They sometimes convert to an irrevocable belief on the loss of life of the grantor.

- Irrevocable: This belief transfers property out of the grantor’s property and cannot be altered as soon as established. Such a belief has extra protections from collectors and extra tax advantages than a revocable belief.

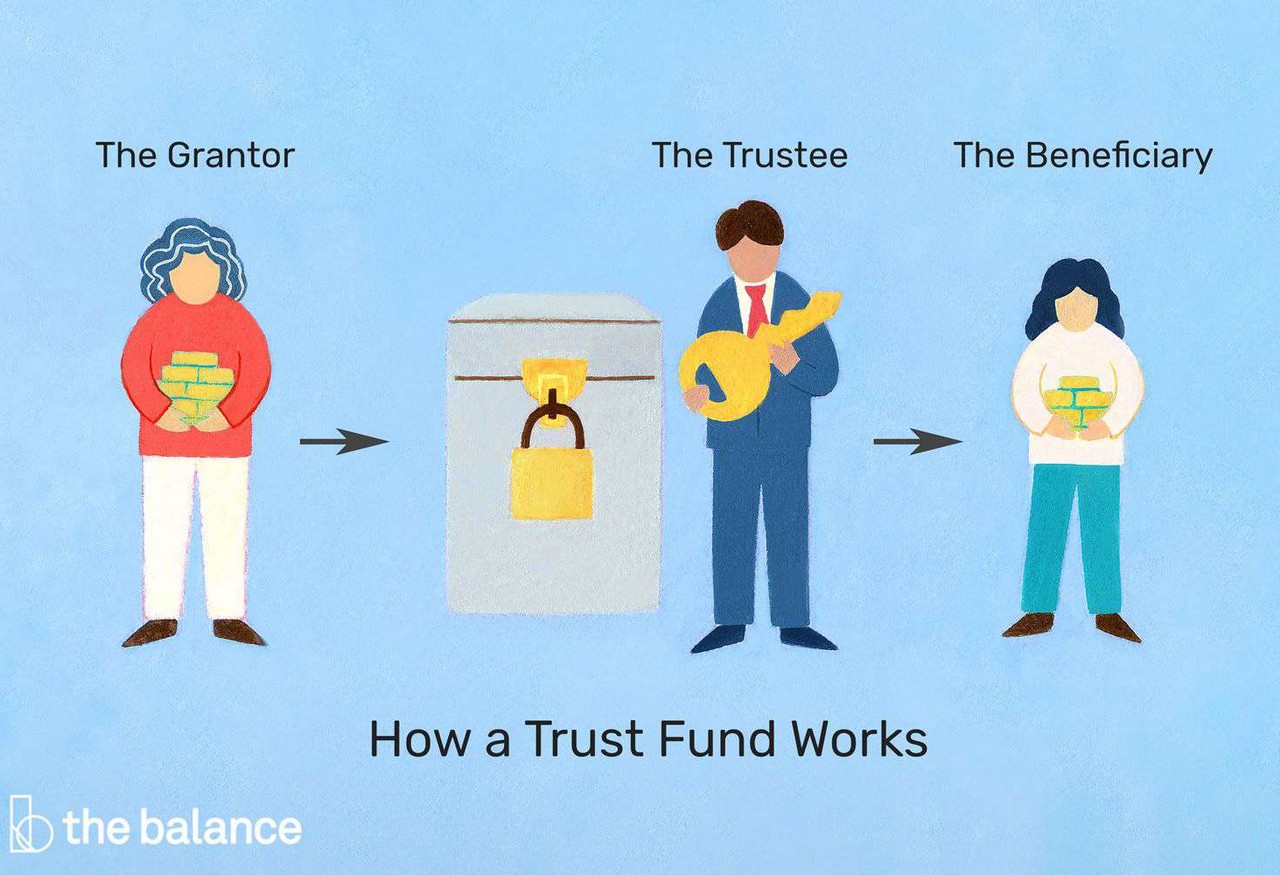

How a Belief Fund Works

A belief fund units guidelines for the way property may be handed on. Suppose somebody desires to depart cash to their grandchildren, however they’re involved about their grandchildren utilizing all the cash whereas they’re younger. The grandparents may put some property right into a belief that stipulates that funds may be accessed as soon as the grandchildren attain the age of 30. Or they could specify that the funds can solely be used for schooling.

Typically talking, there are three events concerned in all belief funds:

- The grantor: This particular person establishes the belief fund, donates the property (similar to money, shares, bonds, actual property, artwork, a personal enterprise, or anything of worth) to it, and decides the administration phrases.

- The beneficiary: That is the particular person for whom the belief fund was established. It is meant that the property within the belief, although not belonging to the beneficiary, will probably be managed in a method that can profit them, as per the particular directions and guidelines laid out by the grantor when the belief fund was created.

- The trustee: The trustee, which could be a single particular person, an establishment, or a number of trusted advisors, is accountable for ensuring the belief fund maintains its duties as specified by the belief paperwork and in accordance with relevant legislation. The trustee is usually paid a small administration price. Some trusts give duty for managing the belief property to the trustee, whereas others require the trustee to pick certified funding advisers to deal with the cash.

Along with the desires of the grantor, belief funds observe state legal guidelines. Sure states could provide extra benefits than others, relying on what the grantor is making an attempt to perform. It is important to work with a certified lawyer when drafting your belief fund paperwork.

Some of the standard provisions inserted into belief funds is the spendthrift clause. This clause prevents the beneficiary from dipping into the property of the belief to fulfill their money owed.

Observe

Some states allow so-called perpetual trusts, which might final endlessly. Different states do not permit these trusts except they’re charitable trusts (trusts that profit charitable organizations).

The Advantages of a Belief Fund

There are a number of causes belief funds are so standard:

- Intentions: In the event you do not belief your loved ones members to observe your needs after your passing, a belief fund with an unbiased third-party trustee can typically alleviate your fears. For instance, if you wish to be sure that your youngsters from a primary marriage inherit a lake cabin that should be shared amongst them, you could possibly use a belief fund to do it.

- Tax advantages: Belief funds can be utilized to reduce property taxes so you will get additional cash to extra generations additional down the household tree.

- Safety: Belief funds can defend cherished property out of your beneficiaries, like a household enterprise. Think about you personal an ice cream manufacturing facility and really feel great loyalty towards your staff. You need the enterprise to proceed being profitable and run by the individuals who work in it, however you need a share of the income to go to your grownup little one, who has an habit downside. Through the use of a belief fund and letting the trustee be accountable for overseeing administration, you’ll be able to obtain that. Your little one would nonetheless get monetary advantages however would haven’t any say in operating it.

- Ongoing transfers: There are some attention-grabbing methods to switch massive sums of cash utilizing a belief fund, together with establishing a small belief that buys a life insurance coverage coverage on the grantor. When the grantor passes away, the insurance coverage proceeds are distributed to the belief. That cash is then used to accumulate investments that generate dividends, curiosity, or hire for the beneficiary to take pleasure in.