When you personal any monetary property, you could have a portfolio, whether or not you understand it or not. A portfolio is the mixture of all of the property you personal. Monetary property akin to shares, bonds, and money are all components of your funding portfolio, which may additionally embrace different property, like actual property.

Realizing about what makes up a portfolio and its makes use of will assist you construct and handle your individual.

What Is a Portfolio?

A portfolio is a broad time period that may embrace any monetary asset, like actual property or gold, however it’s most frequently used to seek advice from the overall of all of your property that earn earnings. An investor’s portfolio, often known as their “holdings,” can embrace any mixture of shares, bonds, money and money equivalents, commodities, and extra.

Some individuals and organizations handle their very own funding portfolios, however there are different choices. Many select to rent a monetary advisor or different monetary skilled to handle portfolios on their behalf.

How an Funding Portfolio Works

An funding portfolio may help you develop your wealth to attain future objectives akin to a stable retirement fund. The fundamental premise is that you just buy investments, which enhance in worth, and because of this, you earn cash.

Asset Allocation

The way in which you select to put money into property to your portfolio, or the kinds of property you purchase, is known as “asset allocation.” Belongings fall primarily into three lessons: equities (shares), mounted earnings (bonds), and money and money equivalents (financial savings and cash market accounts). Inside every primary class, you could have numerous decisions. As an example, equities embrace particular person shares, exchange-traded funds (ETFs), and managed mutual funds.

Diversification

To keep away from being overly uncovered to losses inside a single firm or business, you too can select to diversify your portfolio by shopping for amongst numerous investments throughout many asset lessons.

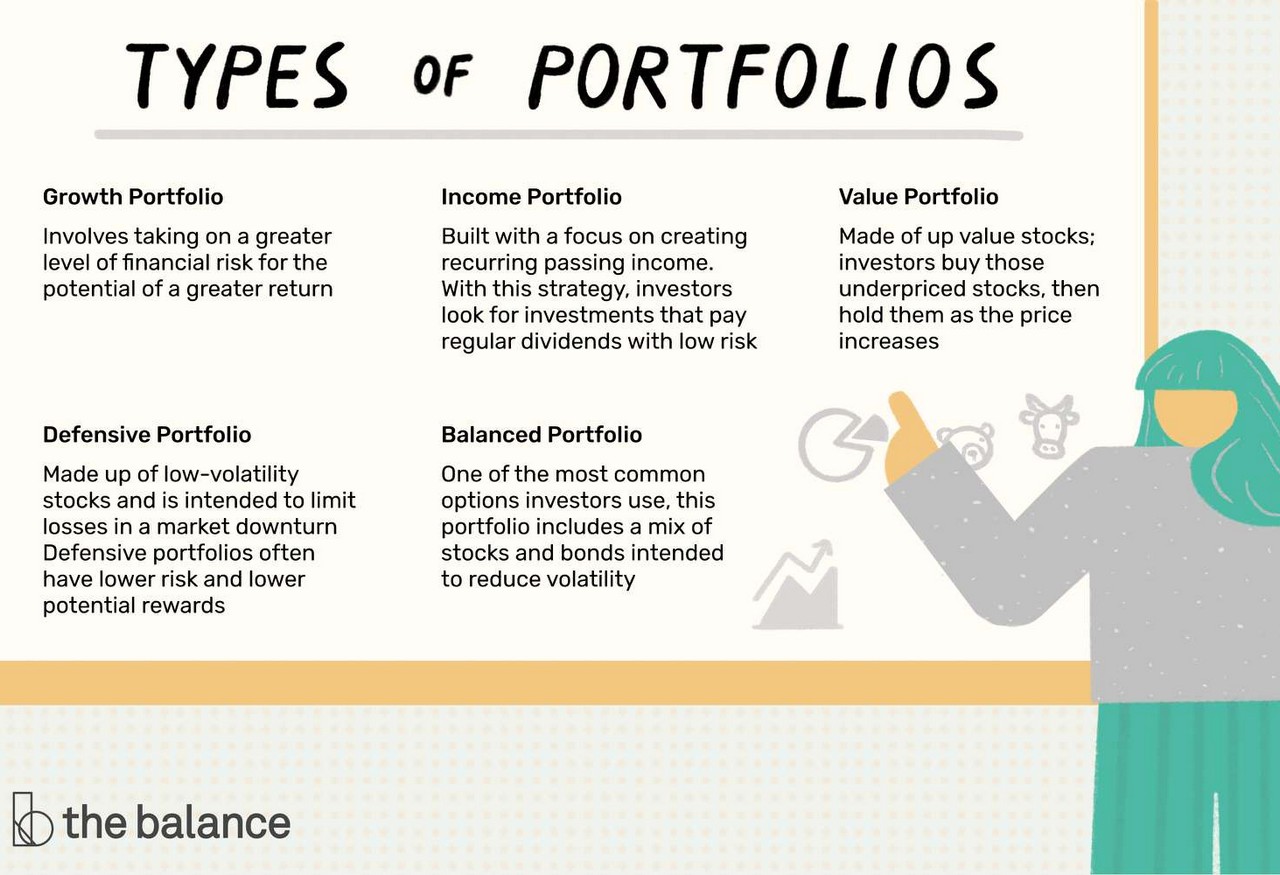

Kinds of Portfolios

You could have already got an funding portfolio within the type of a retirement account by your employer. Others might have portfolios by which they actively purchase and promote property with the aim of constructing a short-term revenue. Some individuals make investments for midterm objectives, akin to shopping for a house. Some have many portfolios designed to perform a spread of objectives.

There are a handful of various kinds of funding portfolios. Every sort pertains to a selected funding aim or technique, and to a degree of consolation with danger.

Development Portfolio

A development portfolio, often known as an aggressive portfolio, entails taking up a better degree of economic danger in alternate for the prospect of a better return. Many development traders search out newer firms that want capital and have room to develop, slightly than older and extra steady firms with confirmed observe data (and fewer room to develop).

Buyers in development portfolios are keen to deal with short-term fluctuations within the underlying worth of their holdings if it means there may be extra potential for long-term capital achieve. This sort of portfolio is right when you have a excessive danger tolerance, or if you wish to make investments for the long-term.

Earnings Portfolio

An earnings portfolio is constructed with a give attention to creating recurring passive earnings. Slightly than in search of out investments which may end result within the biggest long-term capital achieve, traders search for investments that pay regular dividends with low danger to the underlying property that earn these dividends. This sort of portfolio is right if you’re risk-averse, or should you plan to take a position with a brief to medium time horizon.

Worth Portfolio

A price portfolio is product of up worth shares, or shares which can be priced low in contrast with the corporate’s general monetary image. Worth traders purchase these underpriced shares, then maintain them as the value rises.

Slightly than specializing in income-generating shares, traders with a worth portfolio purchase shares to carry them for an prolonged interval with the aim of long-term development. This sort of portfolio is right when you have a average danger tolerance and a very long time horizon.

Defensive Portfolio

A defensive inventory is one with comparatively low volatility in an business or sector that tends to stay principally steady, despite modifications within the broader market. In different phrases, defensive shares signify these firms whose merchandise are at all times in demand, regardless of the state of the financial system.

A defensive portfolio is made up of low-volatility shares with the intent to restrict losses in a market downturn. Defensive portfolios usually have decrease danger and decrease potential rewards. These portfolios work properly for very long time horizons, as a result of they result in smaller however sustained development.

Balanced Portfolio

A balanced portfolio is likely one of the commonest choices traders use. The aim of such a portfolio is to scale back volatility. It principally incorporates income-generating, moderate-growth shares, in addition to a big portion of bonds. The combo of shares and bonds may help you to scale back danger regardless of which means the market is shifting. This sort of portfolio is right for somebody with a low to average danger tolerance and a mid- to long-range time horizon.

Observe

You need not stick to simply certainly one of these methods. A well-diversified portfolio can embrace a mixture of development, dividend, worth, and defensive shares.

Do I Want an Funding Portfolio?

When you don’t presently have an funding portfolio, you may marvel should you really need one. In any case, isn’t the inventory market dangerous?

A 2020 Gallup ballot discovered that solely 55% of People report proudly owning inventory. This determine has been roughly the identical for the previous decade. The ballot additionally discovered that if given an additional $1,000 to spend, about half of the individuals who took the survey (48%) thought it might be a nasty concept to take a position it available in the market, whereas the opposite half (49%) thought it might be a good suggestion.

In fact, there are lots of the reason why individuals may delay constructing a portfolio. They could want the cash to pay for different issues, like every day necessities. Or they could understand the market as extremely dangerous. They could even be cautious of the educational curve that comes with investing. Whereas these issues are legitimate, beginning your funding portfolio is likely one of the greatest methods to develop your wealth and attain main monetary objectives and milestones, particularly a safe retirement.

Observe

A lot of individuals who don’t make investments level to a scarcity of belief within the inventory market or the worry of shedding cash, regardless that the inventory market has seen a mean return of about 10% every year.

Funding Portfolio vs. Financial savings Account

Folks usually use the phrases “saving” and “investing” interchangeably. For instance, we’d speak about saving for retirement in a 401(okay), after we actually imply investing for retirement.

And whereas your financial savings account is technically part of your general portfolio, investing and saving are two very distinct methods.

| Investing | Saving |

| Completed in a brokerage account | Completed in a financial institution or credit score union account |

| Some danger of economic loss | Threat-free so long as the financial institution is FDIC-insured |

| Greater potential return | Little to no potential return |

| Finest for very long time horizons for 3 to five years or longer | Finest for brief time horizons |

| Protects in opposition to inflation | Doesn’t defend in opposition to inflation |

Observe

Low-risk holdings like financial savings accounts are a vital a part of a well-diversified portfolio.

The right way to Construct a Portfolio

1. Determine Whether or not to Handle Your Personal or Rent a Professional

For some individuals, not absolutely understanding methods to make investments is what prevents them from getting began. However for individuals who don’t really feel comfy managing their very own portfolio, there are different choices. One of many first selections you’ll make when constructing your portfolio is the way you need to handle it. Just a few choices embrace:

- DIY portfolio administration

- Utilizing a robo advisor

- Hiring a monetary advisor or cash supervisor

2. Assume About Your Time Horizon

Your time horizon is the period of time earlier than you anticipate to want the cash you make investments. When you’re investing for a retirement that’s roughly 30 years away, your time horizon is 30 years. Specialists typically advocate decreasing your portfolio’s danger as your time horizon shrinks.

For instance, should you’re in your 20s and saving for retirement, you might need a development portfolio that consists primarily of shares. However as you close to retirement age, you possibly can modify your portfolio to comprise extra low-risk investments, akin to authorities bonds. When you retire, you may go for an earnings portfolio to protect capital whereas creating earnings.

3. Determine Your Threat Tolerance

Everybody has a special urge for food for danger. Some individuals may discover the danger of investing thrilling, whereas others need the safety of understanding their cash might be there after they want it. Your danger tolerance has a serious influence on the way you select to construct your portfolio.

A extra risk-averse investor may select to stay with property akin to bonds and index funds. Nonetheless, somebody with a better danger tolerance may discover actual property, particular person shares, and small-capitalization mutual funds.

4. Give attention to Diversification

Diversifying your portfolio is an efficient means of minimizing losses. This implies if one asset performs poorly, it received’t influence your total portfolio. You possibly can diversify each between and inside asset classes. For instance, you possibly can divide your cash amongst shares, bonds, actual property, and commodities—throughout asset classes.

You might additionally diversify inside a single asset class. In apply, which may imply you put money into an index fund that holds shares throughout many industries to attain a wholesome combine.

5. Rebalance as Wanted

Rebalancing is the method of adjusting your holdings to get again to your authentic asset allocation. A few of your investments will develop greater than others, which means they’ll start to take up a bigger portion of your portfolio. To keep up your required asset allocation, you might must promote some property (these by which you’ve seen development) and purchase extra of different kinds of property (people who haven’t had the identical degree of development or have decreased in worth).

- A portfolio is the mixed assortment of an investor’s property, and it may embrace shares, bonds, actual property, money and money equivalents, commodities, and extra.

- Folks usually use their funding portfolios to develop or protect wealth.

- Diversification is a key to holding steadiness amongst property, whether or not for development, financial savings, earnings, or worth.

- You possibly can handle your individual portfolio or pay somebody to handle it in your behalf.

- When constructing a portfolio, assess components that relate to you and your objectives, akin to time horizon and danger tolerance.